Last Updated : 04/16/20204 min read

Annual Deductible For Medicare 2020 Deductible

Summary: The Centers for Medicare and Medicaid Services (CMS) sets the maximum Medicare Part D deductible each year. In 2020, the maximum Part D deductible is $435, but depending on where you live, you may find a plan with a lower deductible or even no deductible at all.

Find affordable Medicare plans in your area

Medicare Part D coverage for prescription drugs is technically optional, but if you enroll in Original Medicare (Part A and Part B), there is very little coverage for prescription medications you take at home. For that reason, most Medicare enrollees choose to buy a Medicare Part D plan to help pay for prescription drugs.

Medicare Part D plans are private insurance plans. Insurance companies are free to design plan benefits and cost-sharing structures to meet the needs of their members, as long as they follow Medicare’s rules for minimum coverage requirements. Your costs and benefits may be different with each plan available in your area. Here’s a breakdown of the costs you can expect with Medicare Part D.

What are my costs with Medicare Part D?

Private Medicare Part D prescription drug plans generally include some combination of the following costs:

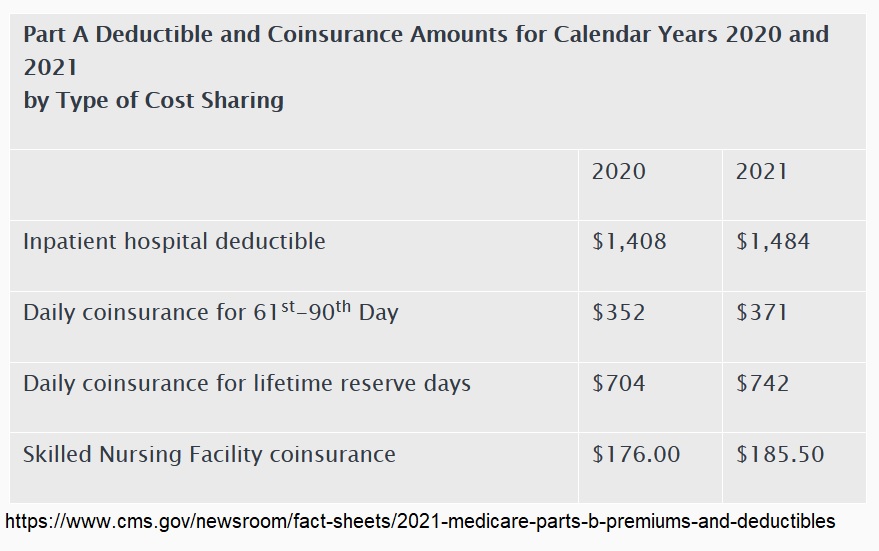

Your Medicare annual deductible is the amount you must pay out-of-pocket before your coverage benefits kick in. The annual deductible for Medicare Part B is $198 for 2020. Once you pay this, you will likely pay a 20% coinsurance for covered Part B services for the rest of the year. Changes to the 2020 Annual Deductible Medicare recipients must meet an annual deductible with Medicare Part B, which is $198 for 2020. If a Medicare enrollee was eligible for a Medigap plan that pays for the Part B deductible prior to 2020, they can still receive that benefit. The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019. The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. People new to Medicare are those who turn 65 on or after January 1, 2020, and those who first become eligible for Medicare benefits due to age, disability or ESRD on or after January 1, 2020. Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R.

- Medicare Part D premiums

- Annual Medicare Part D deductible

- Copayments (flat fee per prescription)

- Coinsurance (a percentage of actual medication costs)

What is the Medicare Part D deductible for 2020?

A Medicare Part D deductible is the amount you must pay each year for your prescription drugs before your Medicare Part D Prescription Drug Plan begins to pay its share of your medications that are covered. This is for a calendar year and resets every January 1. The 2020 maximum deductible set by CMS is $435, however, insurers can set their deductible below the limit. According to research by the Kaiser Family Foundation, 86% of stand-alone Part D prescription drug plans have an annual deductible. Of those, 69% use the $435 maximum established by CMS. If you get your Medicare Part D coverage through a Medicare Advantage plan, you may not pay a deductible.

Once you reach your Medicare Part D deductible, your plan pays its share of your medications. Most plans use a tiered copayment system. Generic medications are in the lower tiers and generally have a copayment of between $0 and $10 each. Expensive brand-name and specialty medications may have a higher copayment or coinsurance amount.

What is the Medicare Part D coverage gap?

Your costs during the deductible phase of your Medicare Part D coverage, as well as your costs and the insurance company’s costs during the initial coverage phase, are added together to determine whether you will move into the coverage gap and catastrophic coverage phase.

In 2020, you enter the coverage gap once you and your insurance company spend $4,020 on prescription drugs in a year. In the coverage gap, you no longer pay your tiered copayment when you buy prescription drugs. You pay up to 25% of the cost of your medications until total prescription drug spending reaches $6,350 in 2020. In the catastrophic phase, you pay a small copayment or coinsurance amount of no more than 5% of the cost of your covered medications or $8.95, whichever is greater, for the rest of the year.

How do I compare Medicare Part D Prescription Drug Plans?

You should look at all three out-of-pocket expenses when you compare plans: Your Medicare Part D premiums, deductible, and copayment or coinsurance amounts. A plan with a higher deductible may have lower monthly premiums. If you don’t use a lot of prescription medications, that may be the most cost-effective option for you. On the other hand, if you take daily medications, a lower deductible may be more important so you get help with your medications with less out-of-pocket expense.

If you take daily medications, it’s very important to look at each plan’s formulary. A formulary is simply the list of covered medications and your costs for each. Check to make sure the plans covers all your daily medications. Also remember a Medicare Supplement Insurance Plan doesn’t cover any costs associated with Medicare Part D coverage.

Finally, compare pharmacy networks and benefits such as mail-order pharmacies. If you have a preferred pharmacy and it’s not in a plan’s network, you may be happier with a different plan. With many plans, you can save on your copayments and out-of-pocket costs by using the plan’s mail order pharmacy for medications you take regularly. If a plan offers this option, you may actually come out ahead even if the plan has a higher deductible or monthly premium, depending on the medications you use.

Annual Deductible For Medicare 2020 Coverage

Limitations, copayments, and restrictions may apply. Premiums and/or copayments/co-insurance may change on January 1 of each year.